Introduction

What is Catalysis?

Catalysis is the first onchain infrastructure to natively integrate coverage into DeFi vaults.

It makes risk coverage a first-class vault primitive — enabling Tier-1 DeFi protocols to offer vaults and structured yield products with embedded, programmable risk protection backed by restaked capital.

Key Highlights

- No third-party or custody risk: Coverage integrates directly with premier vaults on existing Tier-1 DeFi protocols (Morpho, Upshift etc).

- Competitive Pricing: LPs access downside protection with minimal impact on net vault APY. Typically 25-75 bps, depending on risk rating of the DeFi vault.

- Native Vault Coverage: Institutional LPs don’t need to source or manage external coverage from third-party protocols.

- Fully onchain and transparent: Coverage terms and payouts are enforced by smart contracts and executed without manual intervention or committee discretion.

- Simplified Integration UX: Coverage can be plugged into any protocol with minimal effort, no custom infra needed.

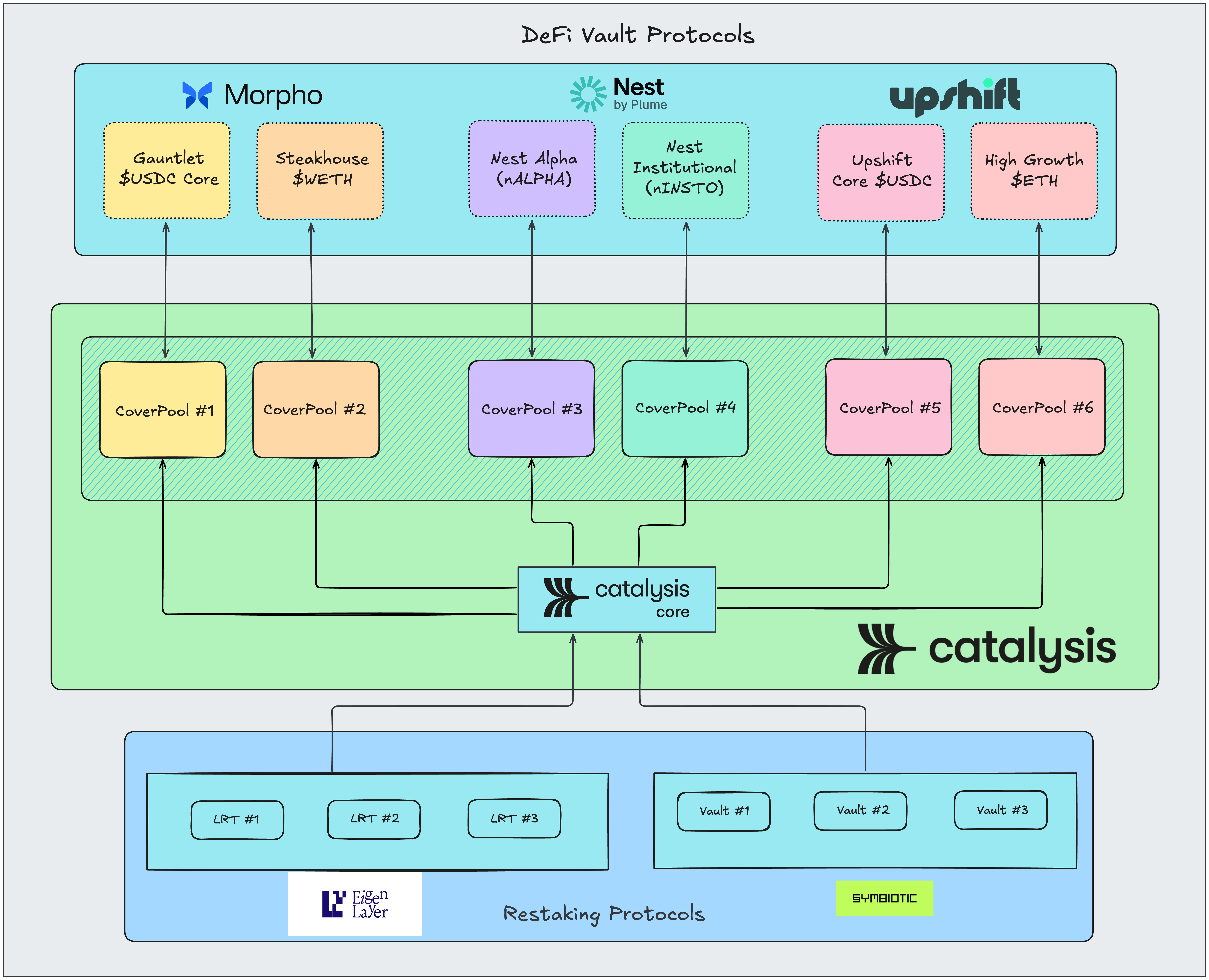

Simplified Architecture

How It Works

Catalysis connects restaked capital, risk underwriting and DeFi vaults into a single, onchain coverage flow.

1. Restakers provide underwriting capacity

Restakers deposit assets such as ETH, BTC and stablecoins into restaking protocols like EigenLayer and Symbiotic. Catalysis Core aggregates this restaked capital.

This pooled collateral represents the system’s raw underwriting capacity — capital that can be programmatically allocated to cover risks on DeFi vaults.

2. CoverPools express risk pricing

Catalysis deploys dedicated coverage vaults called CoverPools. CoverPools act as the operational layer where capital is committed to defined risk profiles.

Each CoverPool sources capacity from Catalysis Core and is configured to underwrite a specific class of risk. For example: an A-rated USDC lending vault versus an A+ WETH-denominated yield vault, based on risk ratings and underwriting parameters.

3. CoverPools issue onchain coverage to DeFi vaults

Once restakers delegate capacity to a CoverPool, that pool can issue onchain coverage to selected, high-quality DeFi vaults on Tier-1 protocols such as Morpho, Nest Credit and Upshift.

Coverage is vault-specific, opt-in and enforced entirely through smart contracts.

4. Premiums and claims are settled programmatically

Coverage premiums paid by covered vault depositors flow directly into the relevant CoverPool and are automatically distributed to restakers.

If a predefined loss event occurs, Catalysis Core enforces slashing on the delegated restaked capital. The slashed funds are then routed to compensate depositors in the covered vault, up to the covered loss amount.

Next Steps

To learn about the stakeholders in Catalysis, check out the Stakeholders overview.

Get started by exploring the Catalysis Core to understand the foundational architecture.